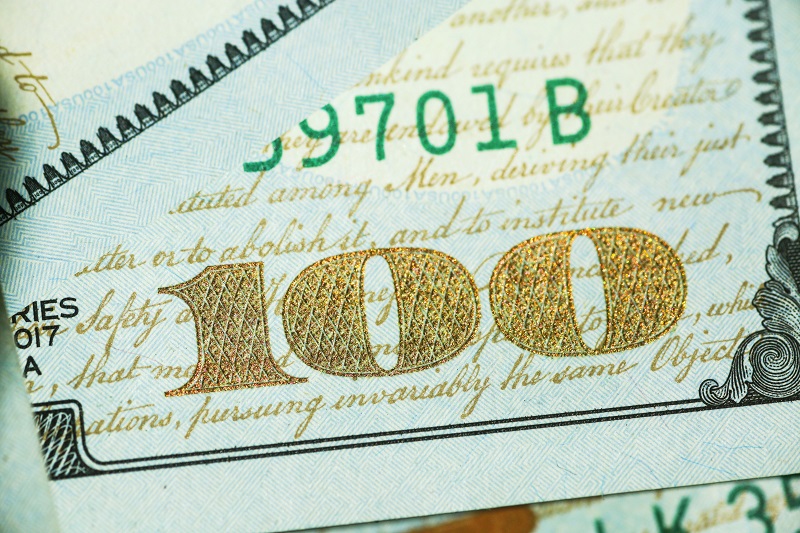

Interest rates set by central banks are one of the most influential factors in the foreign exchange (forex) market. Even small changes in rates can lead to big shifts in currency values, creating opportunities and risks for traders.

For forex traders, understanding how interest rates work and how they impact currency movements can be a game-changer. Let’s explore why interest rates matter, how they’re determined, and how traders can respond to changes effectively.

What Do Interest Rates Mean for Forex Traders?

In forex trading, interest rates play a crucial role because they determine the return on the currency you’re holding. For example, if you’re analyzing popular currency pairs like euro to usd, interest rate differences between the Eurozone and the United States can significantly influence trading decisions.

Currencies with higher interest rates often attract more investors since they offer better returns. This is why traders sometimes favor buying currencies with higher interest rates while funding these purchases with currencies offering lower rates.

However, this strategy isn’t without risk. Currency values can fluctuate, potentially wiping out any gains from interest. It’s essential to factor in market conditions and central bank announcements when making trading decisions.

Who Decides Interest Rates?

Central banks are responsible for setting interest rates and managing a country’s monetary policy. These rates directly influence borrowing costs for banks, businesses, and consumers.

Central banks adjust rates based on the state of the economy:

- Raising Rates: To control inflation when the economy is growing too quickly.

- Lowering Rates: To stimulate growth by making borrowing cheaper during economic slowdowns.

Key economic indicators often guide these decisions. For example, in the U.S., the Federal Reserve considers:

- Inflation measures: Such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index.

- Employment data: Including job creation and unemployment rates.

- Consumer activity: Like retail spending and housing market trends.

By keeping an eye on these indicators, traders can anticipate central bank moves and adjust their strategies.

How Can You Predict Interest Rate Changes?

1. Follow Economic Data

Economic indicators provide valuable clues about potential rate changes. For instance:

- Strong data (e.g., rising employment or consumer spending) might indicate a rate hike to prevent the economy from overheating.

- Weak data (e.g., declining housing sales or stagnant wages) could suggest a rate cut to encourage borrowing and spending.

2. Watch Central Bank Announcements

Public statements from central bank leaders often hint at future rate decisions. For example, if a central bank official emphasizes concerns about inflation, it may signal an upcoming rate hike.

Central bank meetings, policy reports, and speeches are key events to monitor. These announcements can move markets quickly, sometimes even before an official decision is made.

3. Review Market Forecasts

Financial institutions and analysts often release predictions about upcoming rate decisions. Comparing these forecasts can help traders better prepare. For example, if most forecasts agree on a rate increase, traders might position themselves accordingly in the market.

What Happens During a Surprise Rate Change?

Even with thorough preparation, central banks can sometimes catch traders off guard with unexpected rate changes. When this happens, it’s important to act quickly and understand how the market is likely to respond:

- Rate Hike: Typically strengthens the currency as it becomes more attractive to investors.

- Rate Cut: Often weakens the currency as investors look for higher returns elsewhere.

To weather these situations:

- React Fast: The market often moves within minutes of the announcement. Acting quickly can help you capitalize on the change.

- Look for Trend Reversals: While the market may initially react strongly, trends often return to normal after the dust settles.

Central bank press releases also provide valuable insights into their long-term plans, helping traders make informed decisions after the immediate impact of a surprise change.

Final Thoughts

For forex traders, interest rates are more than just numbers—they’re a driving force behind market movements. By understanding how central banks set rates and how currencies react, you can navigate the forex market with greater confidence.

Remember, preparation is key. Analyze economic indicators, watch for central bank signals, and stay ready to adapt to changes. With the right knowledge and strategy, you can turn interest rate shifts into profitable opportunities.

Leave a Reply